rsu tax rate india

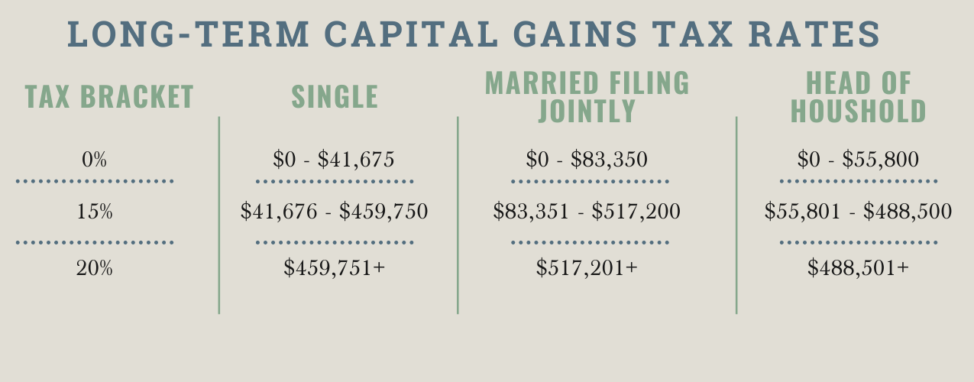

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. Carol nachbaur april 29 2022.

Rsu Taxes Explained 4 Tax Strategies For 2022

RSU can also be given in phased manner sometimes like 25 RSU each year.

. The exact tax rate will. So if company is giving 100 RSUs with condition of 25 RSU vesting each year then 25 shares will. If stock prices are already high holding may be worthless as the prices may not appreciate continuously.

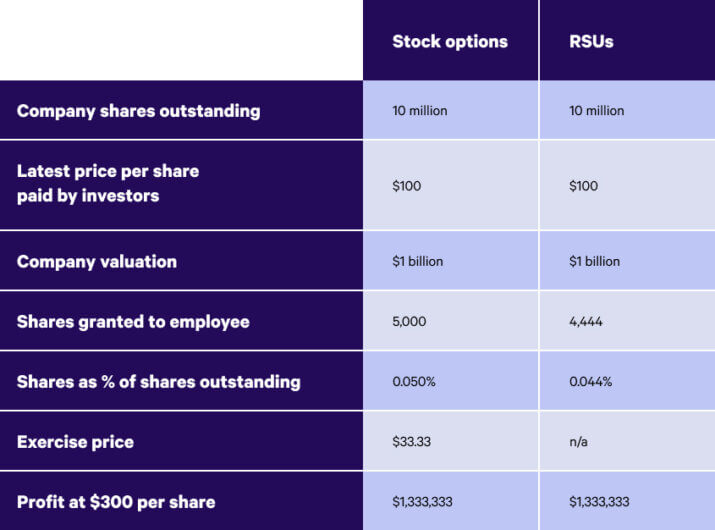

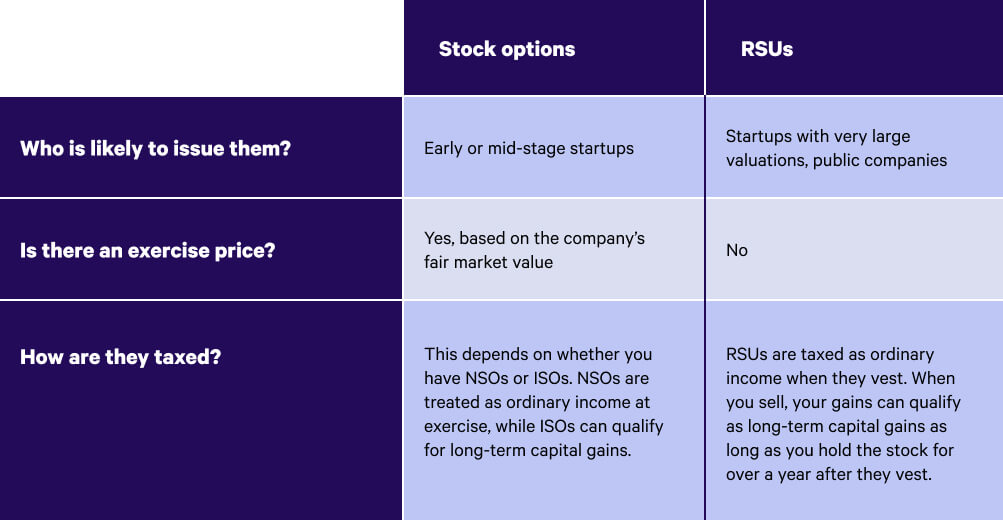

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. New vh5Bx36 Wow that. RSUs are taxed just like if you received a cash bonus on the vesting date and used that money to buy your companys stock.

It too offered its employees the choice between 22 and 37. The price could have fallen from the IPO list price. If population exceeds 10 lakhs but up to 25 lakhs.

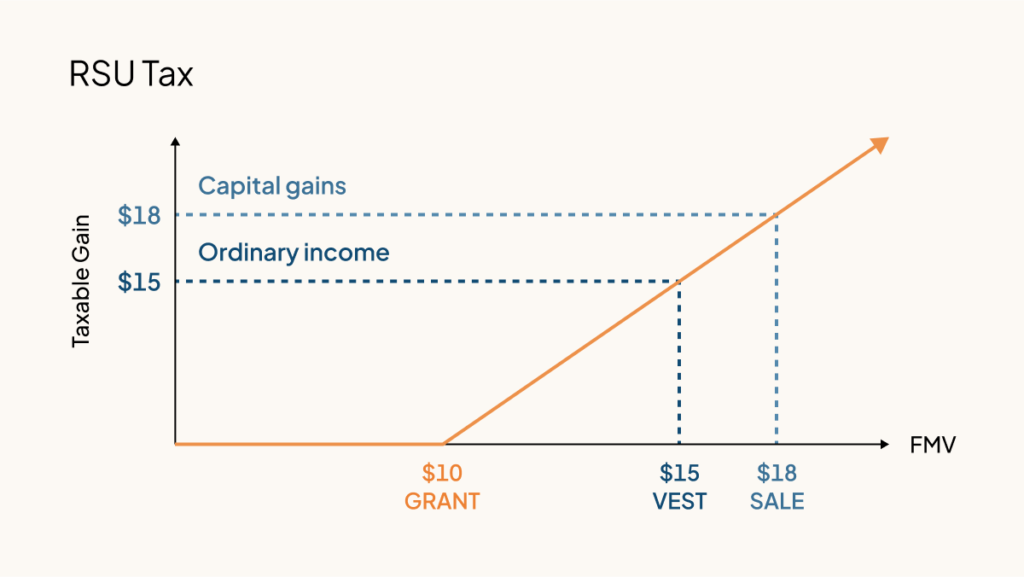

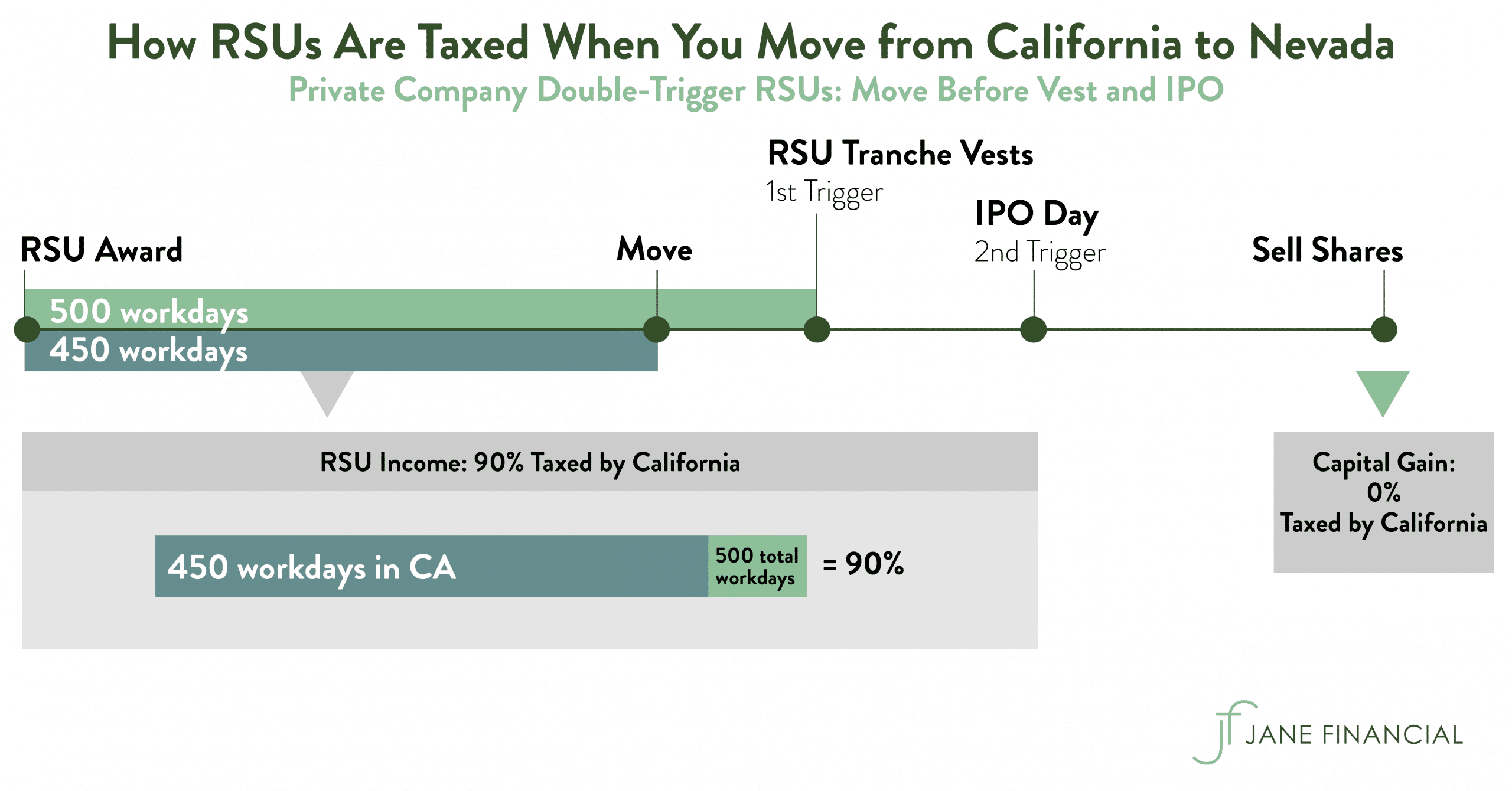

Since RSUs are not a capital asset or financial or equity interest until vested these can be reported as part of other assets in schedule FA in your income tax return. A Guide to Property. The capital gains tax rate when you.

RSUs are taxed at the. Learn more about meaning and taxation of RSU ESOP ESPP. Tax Implications of Restricted Stock.

Robinhood just went IPO on July 28. At Uber they sell off 43 of stocks for tax withholding and return back excess tax to us in cash 43 - 312 12 Jun 8 2021 2 6 View 4 more replies. No RSUs are not taxed twice.

For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess. How is tax calculated for RSUs awarded by MNCs outside India. Hello Generally there is no double taxation since US MNCs with employees in India generally submit W-8BEN to US brokers to avoid any withholding related to US taxes.

10003 Restricted Stock Units 10003 Stocks listed on Foreign Stock Exchanges. Many employers though make it far less convenient for the employee by withholding on supplemental income like RSUs and bonuses at a flat rate which includes. The employee is subject to a flat tax of 15 percent on any net gain resulting from the sale of the shares by Argentine Tax residents or alternatively 135 percent on the gross.

However it can seem like RSUs are taxed twice if you hold onto the stock and it increases in value before you sell it. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. Of shares vesting x price of.

What is the tax rate for an RSU. Regardless of the decision an employee stands to earn a hefty profit by selling. Tax treatment of RSUs in India The RSU.

India proposes slashing tax rate on imported cars in unprecedented move as part of post-Brexit trade deal with Britain By David Averre For Mailonline and Reuters 1531 07 Oct. For senior citizens the. Tax at vesting date is.

When you become vested in your stock its fair market value gets taxed at the same rate as your ordinary income.

Rsus Can Set You Up For Long Term Financial Success

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog

Equity How Does Tax On Rsu Work Quora

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters

Restricted Stock Units The Basics Taxes Youtube

Rsus Vs Stock Options What S The Difference Wealthfront

Rsa Vs Rsu What S The Difference Carta

Rsu Vs Stock Options What S The Difference Personal Capital

Rsus Vs Stock Options What S The Difference Wealthfront

Restricted Stock Units Jane Financial

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Pros And Cons Of Restricted Stock Units Rsus

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Income Tax Implications On Rsus Or Espps

All About Rsus Shares Taxes Applicable What Happens After 4 Years Truth Behind Rsus Youtube

The Taxation Of Rsus In An International Context Sf Tax Counsel